Unpacking Trump's Energy-Related Executive Orders

by Cece

President Trump, on his first day in office, unveiled a slew of Executive Orders. A number of them focused on Energy and Climate, sending clear messages to the world: the US under the new administration will go all in with Energy, whatever the climate impacts are. While this is consistent with his campaign promises and key appointees, from Chris Wright as Energy Secretary to Lee Zeldin to lead the Environmental Protection Agency (EPA), the Executive Orders amplified these intentions through actions.

The most symbolic Order, among all, was to pull the US out of the Paris Agreement, again, via an Executive Order titled “Putting America First in International Environmental Agreements”. In addition, four Orders target the energy industry directly, steering resources from supporting decarbonization solutions to domestic energy expansion.

Let’s examine these Orders more closely.

“Unleashing American Energy” Executive Order

This Executive Order paints a clear picture of how President Trump wants to reshape the energy industry: no green-premium-related incentives for net zero transition; it’s all about domestic energy expansion. A few notable items are as follows:

- Dubbed “Terminating the Green New Deal,” the new administration directs all federal agencies to immediately halt the disbursement of funds allocated through the Inflation Reduction Act (IRA) and the Infrastructure Investments and Job Act (IIJA), mandating all agencies 90 days for implementation.

- The Order targets EVs in particular, eliminating EV mandates and subsidies and pausing funding to electric vehicle charging stations. Under a similar vein of protecting “true consumer choices,” the Order also removes appliance efficiency standards.

- The Order asks the agencies to review the process of implementing the National Environmental Policy Act (NEPA) to simplify the environmental review process. It specifically directs the EPA to review, including considering eliminating the “social cost of carbon” for its “logical deficiencies, a poor basis in empirical science, politicization, and the absence of a foundation in legislation.”

More broadly, the Order withdrew 12 Biden climate/environmental Executive Orders related to climate crisis response, environmental justice, and clean energy initiatives while terminating the American Climate Corps.

On the opposite end, the Order directs the Department of Energy (DOE) to restart reviewing LNG projects and directs various agencies to reassess opportunities for the US to restore critical mineral dominance and evaluate national security implications of mineral competitiveness.

“Declaring a National Energy Emergency” Executive Order

In this unconventional Executive Order, President Trump declared a national energy emergency in the US, claiming the country hasn’t been producing and moving energy fast enough, effectively unlocking the emergency power of the federal government to fast-track energy infrastructure projects. Alarmingly, it singles out the Northeast and the West Coast as the most vulnerable regions - both happen to be at the forefront of clean energy policymaking.

- The Order activates emergency authorities under the National Emergencies Act, directing federal agencies to use any available emergency powers to expedite energy resource development, particularly on federal lands.

- It orders the EPA and the Secretary of Energy to consider issuing emergency fuel waivers to allow the year-round sale of E15 gasoline to meet any projected temporary shortfalls in the supply of gasoline.

- It directs agencies to streamline and expedite the reviewing and permitting needs under the Clean Water Act and the Endangered Species Act, including issuing emergency permitting through the Army Corps.

- It also brings in the military force, asking the Department of Defense (DoD) to assess vulnerabilities in energy acquisition and transportation.

Resource-Specific Orders

Unlike the other two Executive Orders, which touch the broad energy industry, these two Orders direct agencies to examine two specific energy resources, LNG and wind, albeit in opposing directions.

“Unleashing Alaska’s Extraordinary Resource Potential” is effectively an LNG order that directs all departments and agencies to prioritize permitting and development of Alaska’s LNG projects and support the sale and transportation of Alaska LNG at home and abroad.

In contrast, in a Memorandum addressed to several agencies, including the Treasury, Energy, and EPA, the President called to halt the development of all new offshore wind projects and require all wind projects, including both onshore and offshore projects, to be reviewed for their environmental and economic impacts, which is ironically inconsistent given the opposite guidance imposed on other sectors.

Impact on Federal Clean Energy Funding

Among all the Orders, the 90-day freeze of IRA and IIJA funds caused significant concerns in the industry. These two laws, signed in 2021-2022, represented unprecedented federal investments of nearly $600 billion in clean energy and climate initiatives. The IRA provided over $300 billion through a combination of tax incentives ($216 billion), grants ($82 billion), and loans ($40 billion), while the IIJA contributed an additional $130 billion in grants specifically for clean energy infrastructure.

While the precise implications will take months to unfold, it’s important to understand what the President can and cannot do. The core provisions of IRA and IIJA cannot be unilaterally undermined under presidential power as they are congressionally approved laws with funding approved through budget reconciliation. In addition, most of the incentives take the form of tax incentives, which are either automated or protected by the finalized Treasury guidance that the Biden administration managed to push through. As for the grants and loans that are currently under the freeze, most are already committed to various projects and initiatives, diminishing the chance of a complete clawback. The executive branch’s influence is primarily limited to implementation speed and administrative priorities.

That said, Congress could partially or fully repeal the laws through legislation if a simple majority vote in the House and Senate can be reached, which, however, will be a much more difficult process. With most of the incentives benefiting Republican districts, it’s unlikely that a sufficiently large coalition can be formed to challenge the full laws. The primary risks are likely limited to the undistributed funding associated with provisions lacking bipartisan support.

Investment Implications

Although the core incentives may remain intact, the Executive Orders have significantly impacted investment sentiment. In the public markets, clean energy companies have seen their share prices decline substantially. Similarly, in private markets, investors are actively retreating from investments that depend heavily on federal incentives.

The long-term impact is likely more nuanced. By sector, targeted areas such as wind, EV, and carbon management may suffer significant setbacks if proposed measures are materialized. On the flip side, clean energy sources that are classified as “energy resources” under the Executive Orders, including geothermal, nuclear, hydro, and biofuel, may anticipate continued support. The administration’s focus on critical minerals could provide additional opportunities in battery manufacturing and deployment. More broadly, technologies and companies that can stand on their own without relying on incentives will remain appealing. The streamlined permitting processes designed to benefit all energy projects could also accelerate clean energy development by removing long-standing bureaucratic barriers. The expanded LNG exports from the US may also help the global energy transition if consumed by coal-dependent countries as a cleaner alternative in the near term.

The Executive Orders also create regional discrepancies: Alaska is positioned to receive increased federal support for LNG development, while the West Coast and Northeast may face new barriers to their state-level clean energy initiatives. Traditional fossil fuel regions are likely to see accelerated development under the new policies.

The administration’s trade policies add another layer of complexity to the energy landscape, which wasn’t included in the first batch of the Executive Orders and only started to unfold last week. The proposed 10% tariff on Chinese goods, combined with a more aggressive 20% tariff on Canadian and Mexican imports, signals a significant shift in trade relations. These actions could trigger retaliatory measures, particularly affecting critical technologies like battery manufacturing. The broader implications suggest growing global tensions that could significantly impact international energy markets and supply chains.

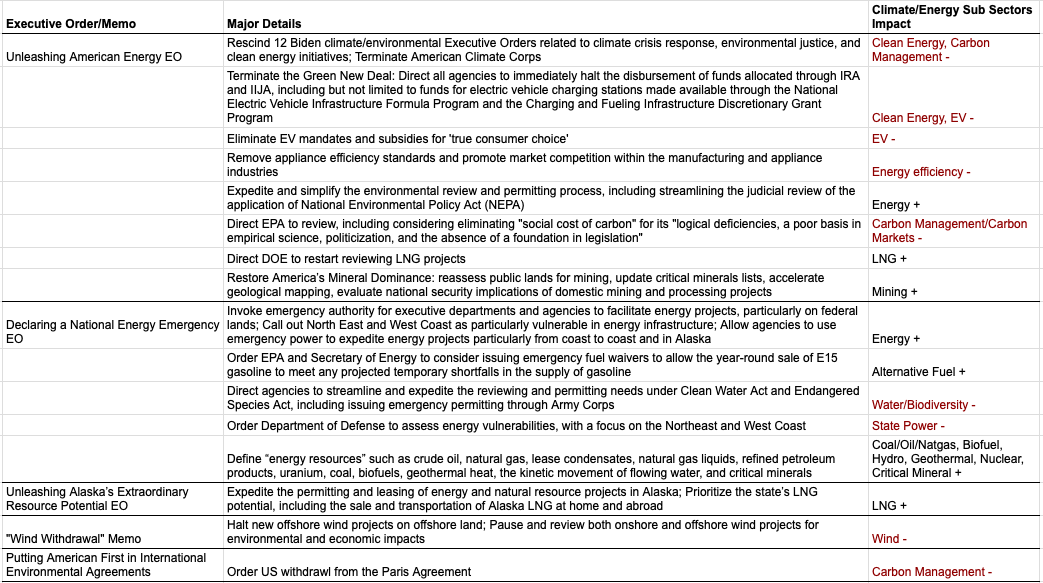

Below are the key details of the latest executive orders and their likely impacts on various climate sub-sectors.

Looking Forward

As the dust settles on these sweeping executive orders, the climate and energy sector faces a period of significant realignment. While federal support for traditional climate initiatives may waver, market forces and state-level commitments continue to drive the clean energy transition forward. Companies and investors are likely to adapt by diversifying their strategy beyond federal incentives, focusing on regions with strong state-level support, and exploring sectors that align with the new administration’s energy expansion priorities. The key to navigating this shifting landscape will be flexibility, strong unit economics independent of federal support, and an acute understanding of both state-level opportunities and geopolitical dynamics. The next four years may reshape America’s energy landscape, but they’re unlikely to completely derail the global momentum toward decarbonization - they’ll just change how we get there.

Subscribe via RSS