Keeping Score of the DOE Loan Program

by Cece

The Department of Energy (DOE)’s recent announcement of a 15 billion conditional loan to PG&E has caught a lot of attention this past week. If finalized, this would be the biggest loan DOE has ever issued to a single company through its Loan Program Office (LPO).

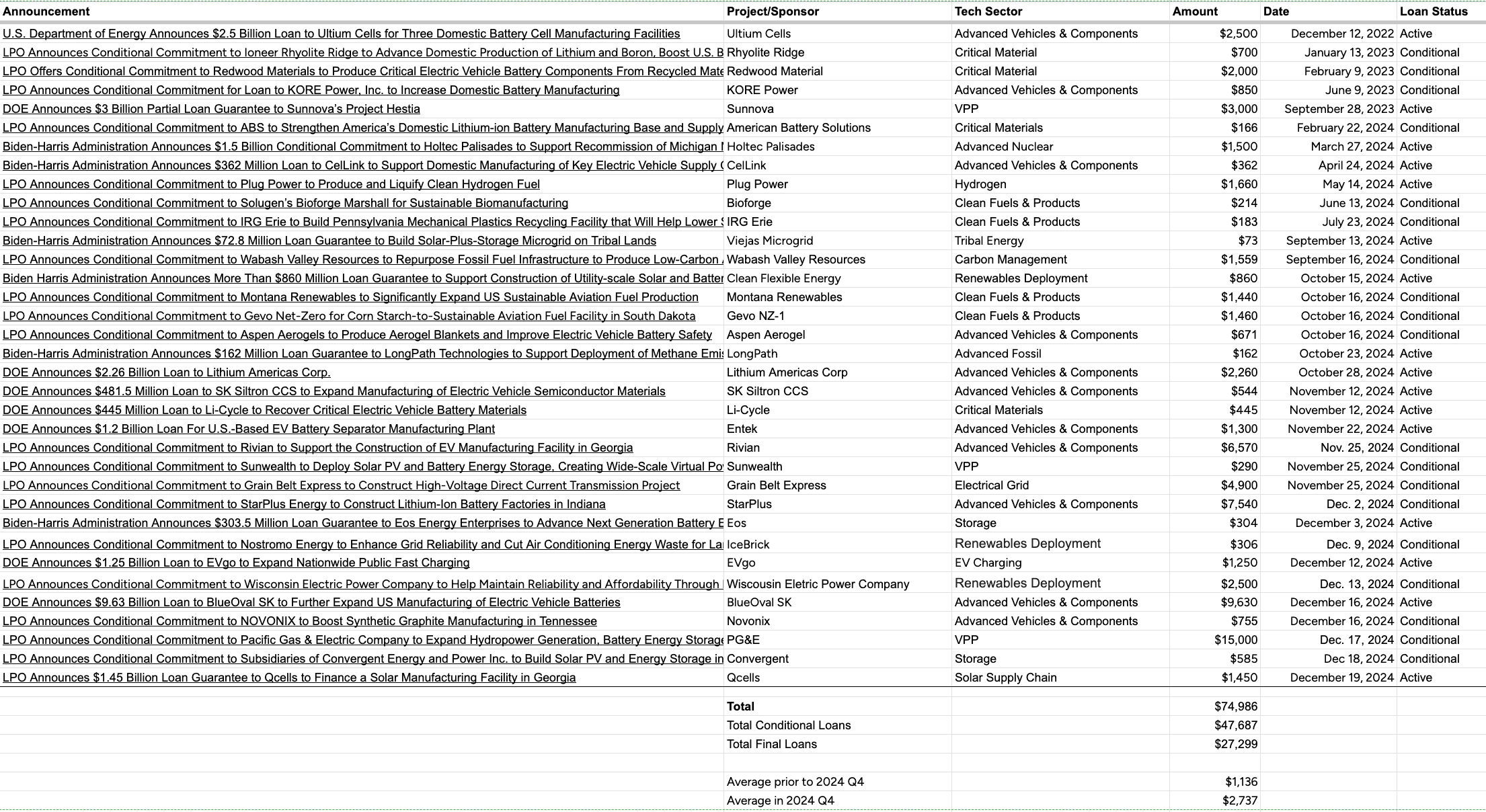

Size aside, the PG&E loan is only one of the many announcements LPO made in the past few months. By scraping the LPO website, I put together a summary of the recent loan issues as below:

Judging from the data, the recent spend from LPO appears different from its past spending trend in three ways:

- Fast: in Q4 2024, LPO announced a total of 22 loans, surpassing the total number of loan issued for the last three years. During the period starting in August 2023, when the Inflation Reduction Act (IRA) was signed into law, only 13 loans were announced up to September 2024.

- Large: The loans announced this quarter are also bigger in check size. Between Aug 2022 and Sep 2024, the average loan size averaged around 1.1billion. The average size of the recent 22 loans nearly tripled the amount, averaging around 2.7 billion, including the jaw-dropping 15 billion loan to PG&E.

- Targeted: LPO is mandated to support 14 tech sectors impacting multiple industries, including power, transportation, industrial, building, and agriculture industries. The recently announced loans appear to target mostly towards technology along the battery supply chain and applications in clean power generation and electrical transportation. EVgo stood out as the first charging company funded through the DOE loan program.

Many see the recent acceleration of loan issuance from LPO as driven by the fear of the incoming administration potentially downsizing its loan authority. Under this belief, LPO hasn’t been moving nearly as fast as needed and is barely playing catch up. As of Nov 2025, LPO still has nearly 400 billion remaining loan authority left for the fiscal year ending in Oct 2025, dwarfing the total 75-billion loan announced thus far. Within the 75-billion loan, two-thirds are ‘conditional’ commitments and are not finalized until the project sponsor takes additional measures required by the term sheet to derisk the projects. Combining these two, over 400 billion dollars supposedly planned for supporting clean energy innovation and commercialization runs the risk of being taken away if the LPO fails to get that money in the next few months.

Is LPO under-delivering? To contextualize what it has achieved in the past three years, one has to trace back to LPO’s own history.

The History of LPO: A Roller Coaster Ride

The history of LPO can be dated back to the 70s, when DOE was officially set up to fund the commercialization of energy technology, especially fracking and nuclear. The DOE pivoted into funding early-stage innovation in the early 2000s and founded LPO in 2005 to support clean energy innovation. Its first prominent moment came under the Obama administration after the Financial Crisis. Supported by the Recovery Act, LPO expanded its mandates to support both innovation and commercialization and served as an important liquidity provider after the Financial Crisis to help struggling, growth-stage clean energy companies survive and thrive. Tesla, for instance, received a large 465-million dollar loan from LPO in 2010, pre-dating the souring relationship between Musk and the government agencies.

The stardom, however, appeared quite short-lived when Solyndra, its portfolio company, went into bankruptcy in 2011. Scrutiny arose not just from the political opponents but also its supporters. People questioned whether the government should use taxpayers’ money to play the bankers’ role. LPO dialed back its lending activities for the next decade.

It only came back into the spotlight in 2022, following the historic signing of the Inflation Reduction Act. While the majority of the IRA benefits wrap around the tax code, LPO also got a boost with a 10x expansion of its lending authority. Yet authority doesn’t automatically translate to trust. Before LPOs could spend any of the dollars, much of the work was spent educating the industry about its role and the process. Not only was debt funding not a familiar capital-raising route for many innovators, the perception of working with the government also deterred some of those who did know. Compared to today’s situation, where LPO has over 200 active applicants and is still receiving, on average, 1 new applicant per week, the limited project supply was the main bottleneck of issuing loans.

In fact, what LPO has achieved in the past three years was nothing but impressive. Used to be a somewhat ‘dormant’ function, it resurrected itself as a leading player in funding and shaping clean energy development through mainly three wedges:

- The bridge towards bankability: many of the clean energy projects are first of a kind (FOAK). Due to their unfamiliar risk profile to funders, the common capital-raising routes, including borrowing from a bank or seeking equity funding, are either unavailable or extremely expensive to them. LPO fills the gap and helps move the project forward to a stage until the private market can take over.

- Unlock private capital: the project that LPO funds often can attract additional funding almost right away due to the improved return profile and the due diligence signaling from DOE. It’s estimated that the multiplier effect from a DOE loan can result in up to 1.5x funding of the original loan size.

- Long-term signal: DOE loans these days are also seen as signaling to the market where to deploy capital. By directing resources to certain technologies, cost curves drop rapidly, and a virtuous cycle is formed for continued organic growth. In essence, it shapes the market without impeding the competition.

The Future of LPO: Will the History Repeat?

While the recent acceleration in spending this quarter can be seen as driven by the ticking clock, it’s also a natural progression as the pipeline of projects applying for DOE loans builds in the last three years. Now the question is, are we at risk of losing all this hard-earned moment? The fear of DOE receding back to the sideline is certainly not unfounded. Yet, there are at least three reasons to be optimistic.

First, the support of the IRA has been bi-partisan. And indeed, most of the IRA benefits, including loan benefits, have gone to Republican-controlled states. At its core, IRA and, by extension, DOE loans, are industrial policies to boost manufacturing activities and economic growth. It would be hard to imagine the Republican-controlled government completely rolling it back altogether.

In addition, despite Trump’s dislike for ‘clean energy’ technologies such as offshore wind, other technologies, including critical minerals and advanced nuclear, should still find their footing under the new administration. LPO can seek further alignment by including additional tech sectors, such as geothermal, in its funding areas for its synergy with the oil industry and the alleged interest from the new Secretary of Energy, who stands to embrace ‘all of the above’ energy.

Furthermore, one thing LPO has done in the past three years was to normalize the concept of funding FOAK projects via a diverse capital stack. Prior to this, most of the innovative projects were funded by equities, usually at a cost of up to 30%. While this may work for low capex SaaS companies, it clearly wouldn’t work for climate tech companies, with the first commercial projects usually only returning modestly above 10%. On the other end of the spectrum, commercial banks and infrastructure investors can fund projects at a rate of 5%, but they are usually quite reluctant to bite into any innovative project due to their unfamiliarity with their risk profiles. LPO, through its own practice, demonstrates how to fund such projects without compromising financial performance. In fact, outside the failure of Solyndra, majority of the LPO sponsored projects are on track to pay back their loans. LPO’s 3% average realized loss is well below industry average. For an equity investor who invests along LPO, the hypothetical payoff is estimated to be in the top 10 percentile compared to a growth-stage PE fund.

Whatever the future looks like, the Office has reclaimed its role as a leading player in the capital market and guidepost in intermediate to long-term business opportunities. Besides direct lending, it demonstrates the financial viability of innovative clean technologies, creates the market by bridging the commercialization valley of death, and attracts substantial co-investors from the private markets. With more than 200 active applicants summing up a total of 300 billion dollars in loan amounts, the next few months are critical for the LPO to strategize its future positioning while further stockpiling capital and resources for the industry to weather the storm.

Subscribe via RSS